Millennials and Gen Z talk a lot about values. Fairness, ethics and community are supposed to matter more to them than to any generation before. On the surface, credit unions should be their ideal choice. They were built on these very principles. And yet, fewer than one in four young consumers call a credit union their primary financial institution. Why is that?

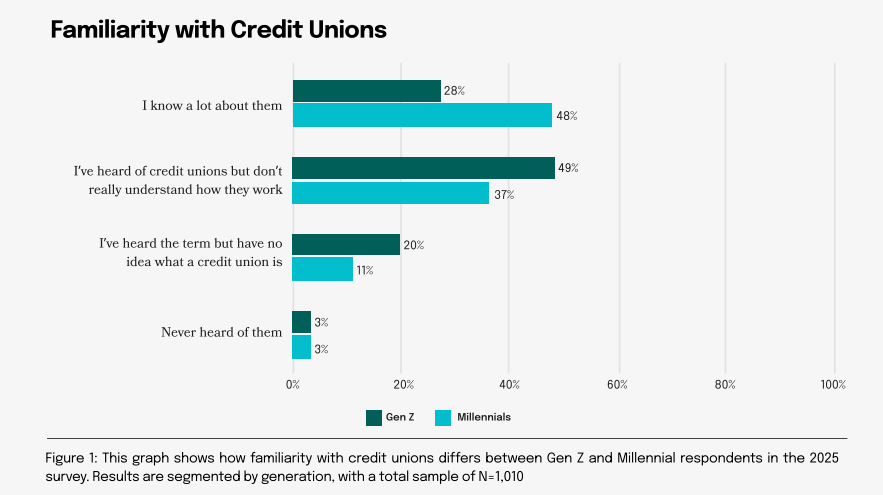

Sogolytics set out to explore this contradiction in a national survey. The results raise tough questions. Nearly half of Gen Z say they have heard of credit unions but still don’t really know how they work. Among Millennials, membership has slipped from almost one in three in 2023 to just over one in five today.

Gen Z Knows Credit Unions Exist but Doesn’t Understand Them

Source: Sogolytics, Credit Union Survey 2025

66% of Millennials and Gen Z claim they try to support brands aligned with their values, but only 35% believe their financial provider actually reflects those values. And while credit union members often report strong satisfaction with digital tools, outsiders still see them as outdated or “not modern.”

So where does that leave the movement? The evidence suggests this is not about awareness anymore, young people know credit unions exist. What they are missing is clarity, relevance, and a sense of urgency. Unless credit unions can show how their values translate into real, everyday benefits and pair those values with simple, seamless digital access, the next generation may never look their way. The opportunity is still there, but the window is closing fast.