On November 10, Sogolytics hosted a webinar titled “Uncovering Key Insights to Increase Customer Satisfaction in Retail Banking.” The webinar explored the key drivers of the customer and member experience and how they can help financial institutions to optimize engagement and boost satisfaction and loyalty.

Challenges facing financial institutions

Today’s financial institutions face numerous hurdles that often prevent them from fully engaging customers and achieving high satisfaction ratings.

- Outdated or legacy technology: Older technology brings inherent security risks and inefficiencies, along with an inability to keep up with customer demand for a highly integrated, mobile banking experience.

- Lack of actionable CX data: Those institutions who leverage customer satisfaction data see a noticeably faster resolution to customer issues or complaints, and those who unify operational data with customer data are far more likely to boost loyalty.

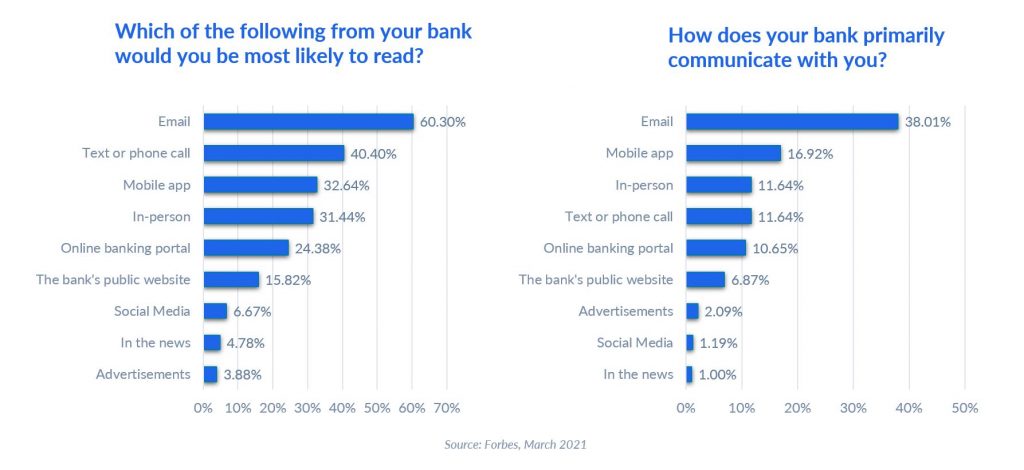

- Misunderstanding customer preferences: There is a misalignment between what the customer wants, and what institutions think the customer wants. According to The Financial Brand, 70 percent of Gen Z, Gen X, and Millennial customers want to open new accounts online, but not all financial services institutions allow new customers to open accounts online. Additionally, according to a Forbes study conducted earlier this year, the communication channels preferred by retail banking consumers — email, text, phone call — are largely under-utilized by their banks.

Overcoming these obstacles begins with understanding customer preferences, and that can best be accomplished with a dynamic CX program that grants the institution insights into what the customer wants. Having this kind of insight allows banks, credit unions, and other institutions to focus their attention on making changes with the biggest impacts.

Understanding the customer journey

Institutions must have a clear understanding of the customer journey, along with the key drivers that impact each stage of that journey. In order to boost metrics such as NPS, CSAT, or CES, it’s imperative to know what factors are impacting these scores at exactly the right point in the customer journey.

But collecting this feedback is only half the story — the real work comes in analyzing high volumes of CX data to uncover key insights.

- One way to do that is by analyzing open-ended questions in a survey, which offers more clarity into customer sentiment than many other types of questions.

- Sogolytics’s CX dashboard also offers an indispensable tool for analyzing large amounts of CX data. The dashboard displays weak and strong points in the customer journey, and the user can easily filter by branch location, customizable metrics, and much more. The dashboard also allows institutions to input milestones, and set markers and goals.

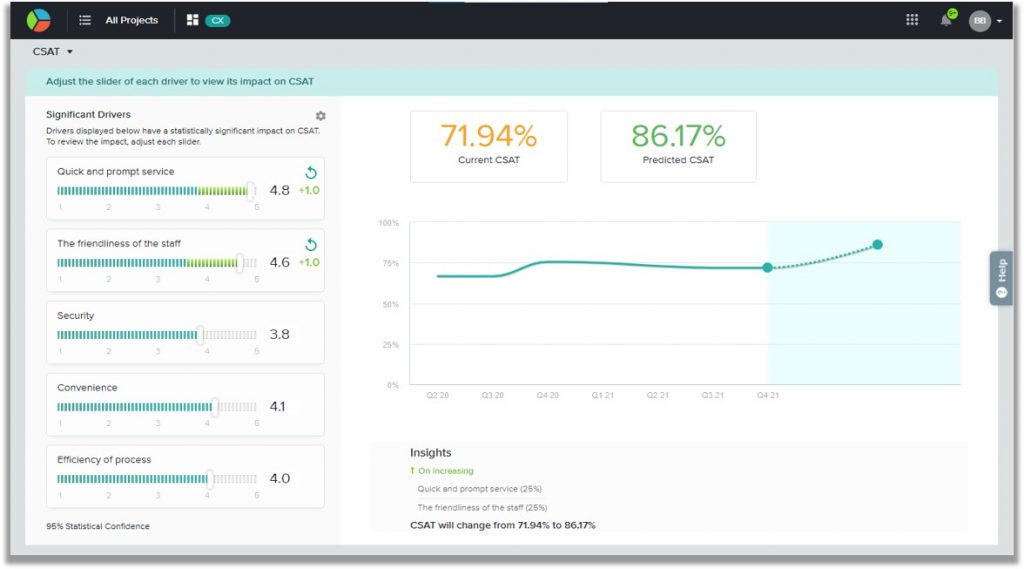

- Yet another valuable tool is Sogolytics’s new predictive analytics feature, allows users to select a metric, such as CSAT, and adjust the key drivers affecting that score to make predictions about what will happen when individual areas are targeted for improvement.

Remember, 63% of customers will pay more for a great experience.

Visit our webinar page to view this and many other presentations at your convenience. Want to speak with someone about how Sogolytics can help your financial institution boost satisfaction and loyalty? Connect with us today!